New rules raise costs fast. I faced sudden tariffs on aluminum. It hit my first big US order hard.

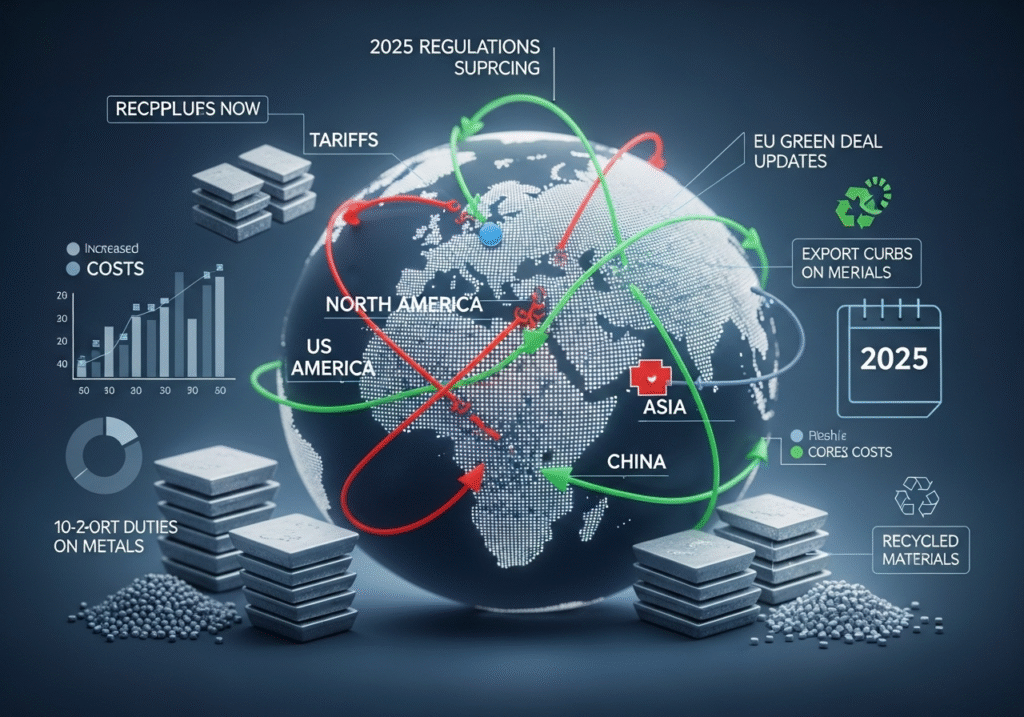

2025 regulations like US-China tariffs, EU Green Deal updates, and China’s export curbs impact sourcing. They push for recycled materials and add 10-25% duties on metals, so buyers need compliant suppliers now.

I source materials for my China factory. Rules change often. They affect every track we make. Let’s dig into four key ones that shape your buys.

How Do US-China Tariffs Affect Aluminum Sourcing for Curtain Tracks?

Tariffs surprise importers. I paid extra 25% once. It cut my margins thin.

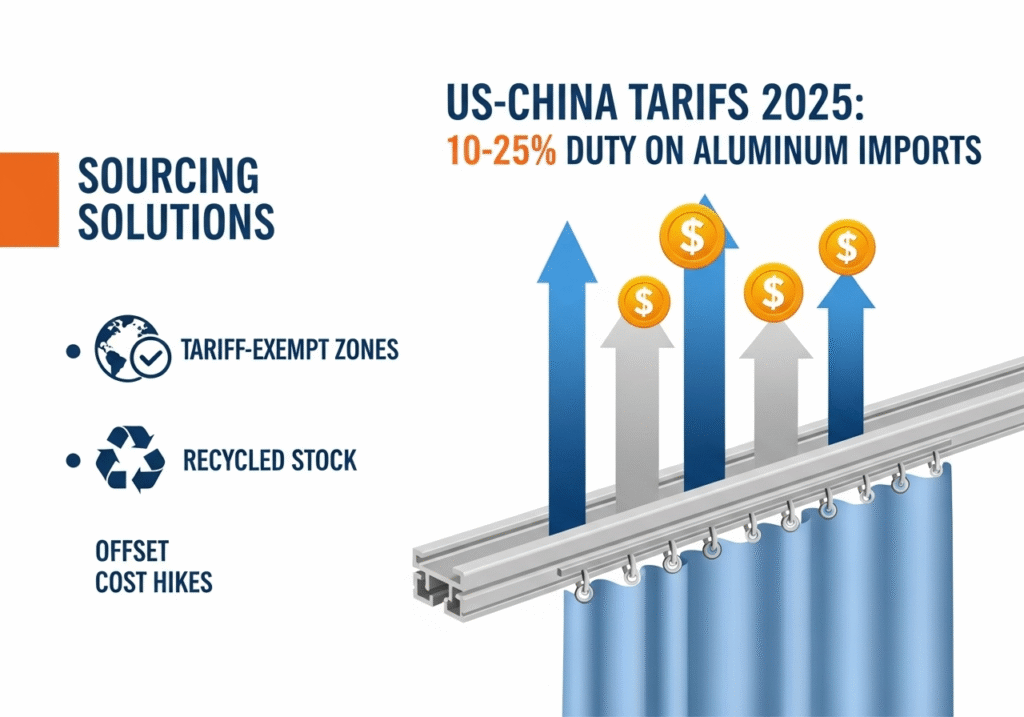

US-China tariffs in 2025 add 10-25% duties on aluminum imports. They raise costs for curtain tracks, so source from tariff-exempt zones or use recycled stock to offset hikes.

Tariff Rate Changes

Tariffs hit metals hard. In 2025, aluminum duties rose to 25% from 10%. This stems from trade acts. My factory shifted to low-tariff alloys. A US brand client saw costs jump 15%. We helped by blending local scrap. Buyers must check HTS codes—8708 covers hardware. Exemptions apply via USMCA, but few qualify.

Sourcing Strategies

Use bonded warehouses to delay duties. I negotiated with a Canadian mill for blends. This saved 8%. Track updates via USTR site. For tracks, opt for 6063 aluminum—it’s lighter, less taxed.

| Tariff Level | Rate Increase | Cost Impact on Tracks | Mitigation Tip |

|---|---|---|---|

| Basic Aluminum | +15% | $0.50/meter | Recycled Blends |

| Extruded Profiles | +25% | $1.00/meter | USMCA Partners |

| Coated Alloys | +10% | $0.30/meter | Duty Drawback |

This table shows hits and fixes. It helps plan budgets tight.

What EU Sustainability Rules Change Recycled Material Requirements?

Green rules lag behind. I missed REACH once. It blocked a EU shipment cold.

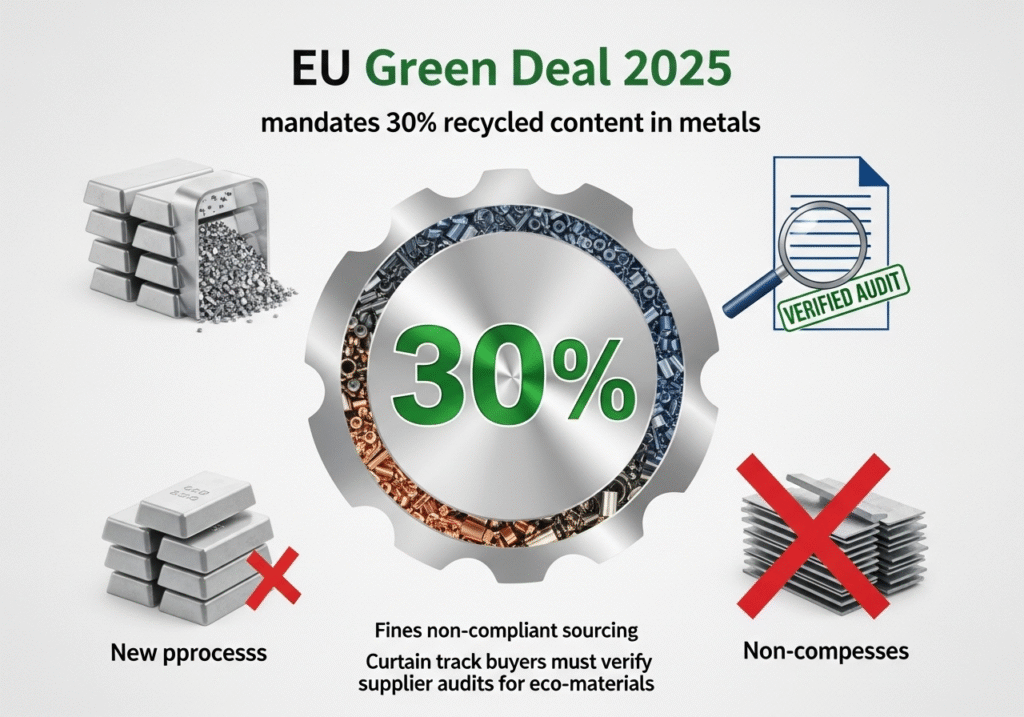

EU Green Deal 2025 mandates 30% recycled content in metals. It fines non-compliant sourcing, so curtain track buyers must verify supplier audits for eco-materials.

Recycled Content Mandates

The Deal sets 30% recycled aluminum by mid-2025. This cuts virgin mining. My factory hit 40% with scrap feeds. A German architect demanded proof—we shared certs. Fines reach 4% of sales. Tracks count as building products under CPR. Use EPDs for claims.

Compliance and Audits

Third-party checks like SGS verify. I ran one for a hotel chain. It cost $2k but won bids. 2025 adds carbon border tax—up to 20% on high-emission imports. Shift to low-carbon alloys early.

| Rule Aspect | Requirement | Fine Risk | Compliance Cost |

|---|---|---|---|

| Recycled % | 30% Min | 4% Sales | $1-3k/Audit |

| Carbon Tax | <500 kg CO2/t | 20% Duty | EPD Reporting |

| Audit Freq | Annual | Import Ban | Supplier Certs |

This table maps rules to actions. It keeps EU doors open.

How Do China’s Export Restrictions Impact Steel Supply Chains?

Curbs hit sudden. I scrambled for steel last year. Orders delayed weeks.

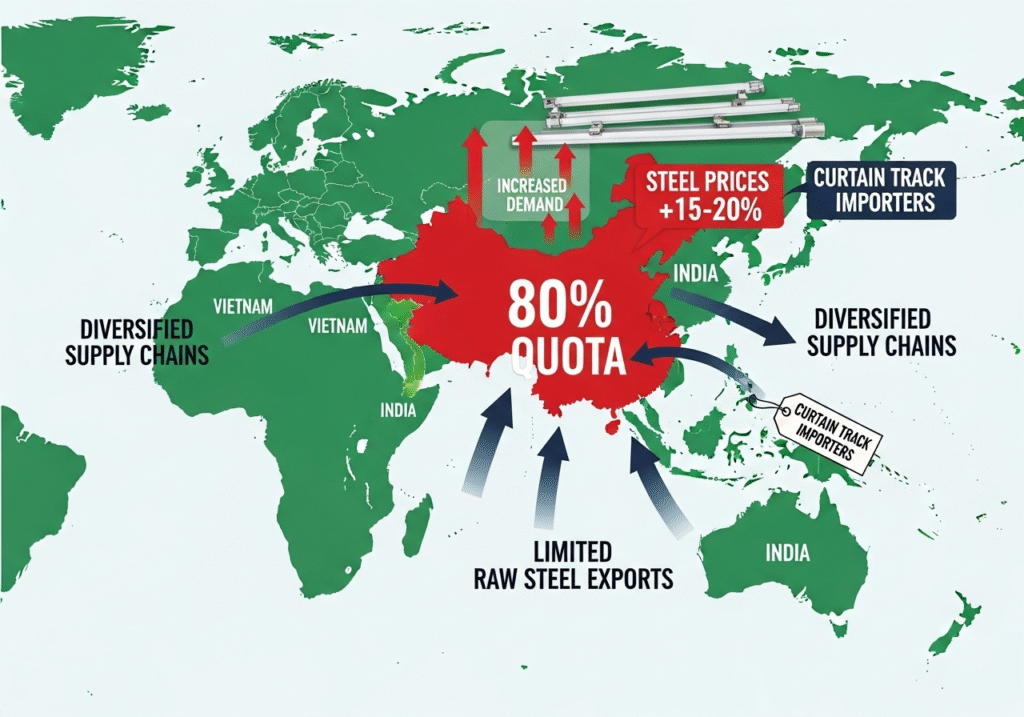

China’s 2025 export curbs limit raw steel to 80% quota. They spike prices 15-20% globally, so curtain track importers need diversified chains from Vietnam or India.

Quota and Price Effects

Curbs cap exports at 80 million tons. This follows domestic needs. Steel for tracks rose $200/ton. My supply chain diversified to ASEAN. A US builder faced 18% hikes—we sourced alternatives. Track to MOFCOM announcements. Impacts hit Q2 hardest.

Diversification Steps

Build dual suppliers. I added Indian mills—lead times match. Costs up 5% but stable. Use futures contracts to hedge. For galvanized steel in tracks, check anti-dumping duties.

| Impact Area | Price Rise | Delay Risk | Alternative Source |

|---|---|---|---|

| Raw Steel | +15% | 4-6 Weeks | India |

| Galvanized | +20% | 3 Weeks | Vietnam |

| Coils for Extrusion | +12% | 2 Weeks | Turkey |

This table charts shifts. It steadies your flow.

What New Trade Agreements Influence Tariff Exemptions for Hardware?

Deals shift uneven. I missed a FTA clause once. Duties ate profits.

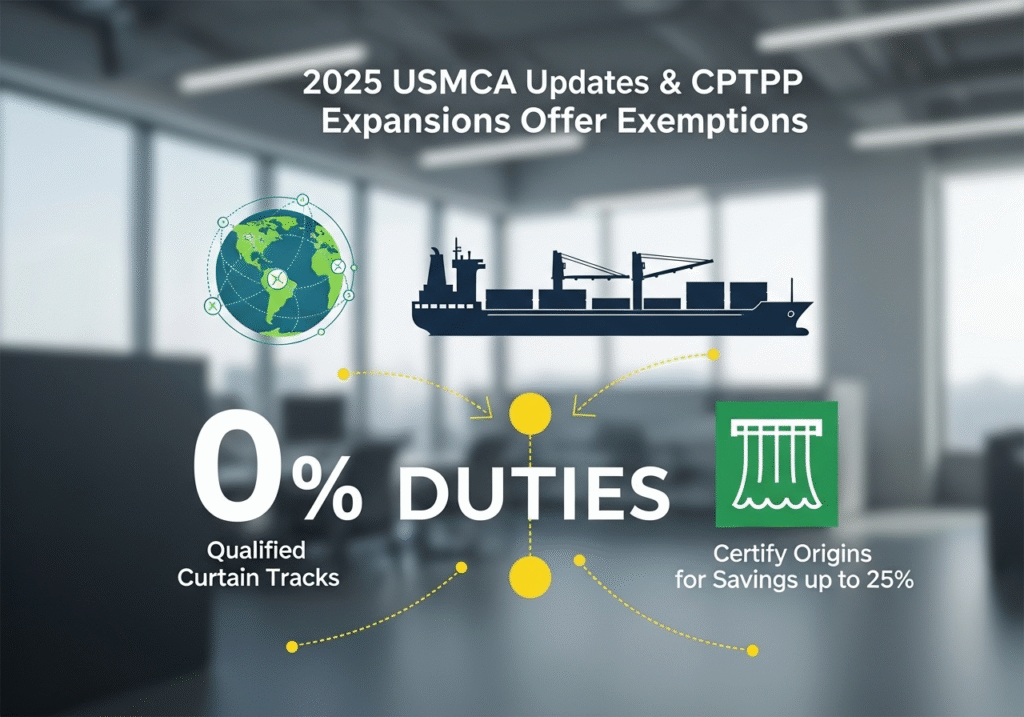

2025 USMCA updates and CPTPP expansions offer exemptions. They cut duties to 0% on qualified curtain tracks, so certify origins for savings up to 25%.

Exemption Qualifications

USMCA requires 75% North American content. CPTPP covers Asia-Pacific. My factory certs via NAFTA rules. A Canadian intermediary saved 22%—we stamped origins. 2025 adds digital tracking for claims. Hardware like tracks qualifies under Chapter 84.

Certification Process

Get COs from chambers. I streamlined for EU clients. Costs $100/order but pays back. Watch WTO disputes—they tweak rates. For aluminum tracks, prove non-Chinese melt.

| Agreement | Exemption Rate | Qualification | Savings Example |

|---|---|---|---|

| USMCA | 0% | 75% Content | 25% on Aluminum |

| CPTPP | 0-5% | Origin Rules1 | 18% on Steel |

| EU-China FTA | 10% Reduction | Eco Certs2 | 15% on Recycled |

This table unlocks deals. It trims your tabs.

Conclusion

2025 rules like tariffs, green mandates, export curbs, and trade pacts shape sourcing. Adapt now for steady supplies.