You’re a procurement manager trying to plan for the next big thing: smart curtain tracks. But your traditional forecasting methods are failing you. The market is new, historical sales data is nonexistent, and you’re caught between the fear of missing out on a growing trend and the risk of overstocking on expensive, high-tech components that could become obsolete in six months. How can you make a smart bet when the future is so uncertain?

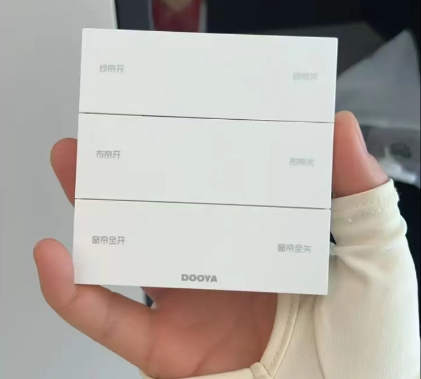

The most effective way to forecast demand for smart curtain tracks is to stop thinking about them as "tracks." Instead, you must forecast them as two separate components: the simple aluminum track and the complex electronic motor assembly. The key leading indicator for demand is not linear meters of track, but the adoption rate of specific building automation ecosystems like KNX, Crestron, or Lutron. Tracking these system choices is the only reliable way to predict which motor technologies you’ll actually need.

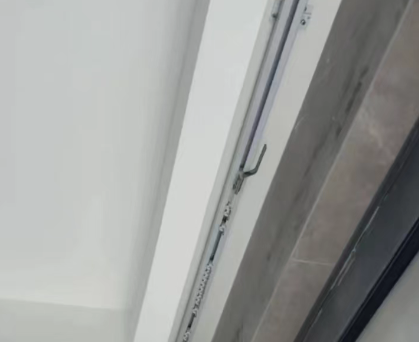

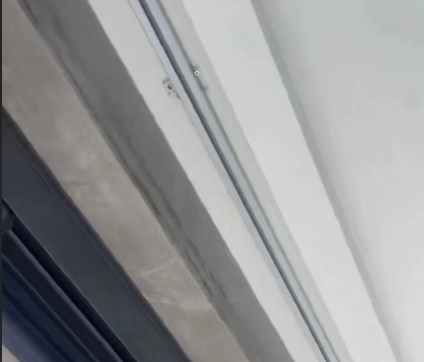

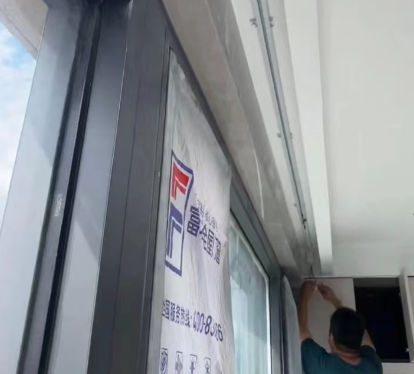

This insight comes directly from my experience on the factory floor. When we get an order for a smart curtain track, we don’t see it as one product. We see two entirely different supply chains. The first is for the aluminum track itself. This is a commodity; it’s predictable, stable, and the risks are well understood. The second is for the motor, the control unit, and the wireless module. This is a volatile, high-tech supply chain with completely different lead times and risks, all dictated by the client’s choice of automation system. A manager who is only tracking aluminum prices is watching the wrong variable entirely and is blind to the real risks.

What data sources and signals can you use to estimate demand?

Trying to forecast demand for smart curtain tracks using last year’s sales data is like driving while looking in the rearview mirror. This product category is so new that historical data is misleading at best, and completely useless at worst. You see the industry buzz, but you have no hard numbers to base your inventory decisions on. You’re pressured to stock up, but you’re essentially guessing, risking thousands in capital on a hunch that could easily be wrong.

To estimate future demand for smart curtain tracks, you should use forward-looking data from parallel industries. The most valuable signals come from tracking architectural specifications for new commercial projects, monitoring the sales and integration data of building automation systems (BAS), and analyzing consumer adoption rates for mainstream smart home technology. These data sources act as leading indicators, showing you what the market will demand 6 to 18 months from now, long before the purchase orders are written.

I learned early on that to predict the future, you have to look at what designers and architects are planning today. We started paying less attention to our direct competitors’ product launches and more attention to announcements from companies like Crestron, Lutron, and even Amazon. Their roadmaps tell us what communication protocols and integrations will be required in the hotels and high-end homes of tomorrow. This shift in focus changed how we manage our component inventory.

Tracking Building Automation System (BAS) Specifications

The single most important decision on a large project (like a hotel) is the choice of the central automation system. If an architect specifies a KNX system for a new hotel, we know with certainty that every smart product in that building, including the curtain tracks, must be KNX-compatible. By tracking data from architectural databases (like Dodge Construction Network) or building relationships with BAS integrators, you can get a clear picture of which systems are gaining traction in your market. This directly informs which types of motors you need to stock.

Analyzing Smart Home Technology Adoption Rates

For the residential market, the signals are more consumer-driven. Keep an eye on adoption rates for major smart home ecosystems like Amazon Alexa, Google Home, and Apple HomeKit. Also, track the emergence of new universal standards like Matter. When a new standard gains momentum, it signals a shift in the market. A homeowner who is already invested in the Google ecosystem will demand a smart curtain that works seamlessly with it. This data helps you forecast demand for motors with specific Wi-Fi or Zigbee modules that are compatible with these platforms.

Leveraging Forward-Looking Project Data

Don’t wait for the purchase order. Develop relationships with architectural firms, interior designers, and project developers. Get involved in the specification phase. By understanding the pipeline of projects planned for the next 12-24 months, you can see demand developing long before it hits the procurement stage. This "soft" data is often more valuable than any quantitative report because it comes with context about the project’s scale, budget, and specific requirements.

| Data Source | Type | Value for Forecasting | Lead Time |

|---|---|---|---|

| Architectural Databases | Quantitative | Tracks which BAS are specified in new builds. | 12-24 months |

| BAS Integrator Data | Qualitative/Quantitative | Real-world data on system installations and preferences. | 6-18 months |

| Smart Home Ecosystem Reports | Quantitative | Shows which consumer platforms are winning market share. | 6-12 months |

| Direct Project Pipeline | Qualitative | Specific, confirmed demand for upcoming projects. | 3-18 months |

What internal and external factors most influence forecasting accuracy?

Your forecast for smart curtain motors seemed perfect. You analyzed the market and placed a large order for Wi-Fi-enabled motors. Then, two things happened. Externally, a key chip supplier announced a six-month delay, halting production. Internally, your sales team wasn’t properly trained on the new product, so they continued selling the older, simpler models they were comfortable with. Now you have an unmet demand for one product and a warehouse full of another, and the accuracy of your forecast is being questioned.

Forecasting accuracy for smart curtain tracks is heavily influenced by both external and internal factors. The most critical external factors are the volatility of the semiconductor supply chain and the shifting landscape of smart home communication protocols (like Matter or Zigbee). Internally, the biggest influencers are the sales team’s ability to sell a complex tech product and the effectiveness of marketing efforts in educating customers about the benefits. A successful forecast requires you to monitor all of these variables, not just the market demand.

We’ve lived through this exact problem. We once invested heavily in a motor with a specific communication chip, only to have the chip manufacturer phase it out with little warning. It was a painful lesson. We learned that for our smart products, our supply chain risk isn’t in the aluminum—it’s in the silicon. Now, we maintain relationships with multiple motor and chip suppliers and spend as much time reading tech news as we do metal market reports. It’s a fundamental shift in how we manage our business.

The Semiconductor Supply Chain Effect

The "brain" of a smart curtain motor is a collection of microchips. The availability of these tiny components has a huge impact on your ability to procure motors. A disruption in a single chip factory in another part of the world can halt production for your motor supplier for months. Accurate forecasting requires you to have visibility into your supplier’s supply chain. You should ask your motor manufacturer about their chipset sources, their buffer stock policies, and their contingency plans for shortages.

The Ecosystem Compatibility Factor

A smart curtain motor is useless if it can’t talk to the building’s other smart devices. The battle between automation ecosystems (KNX, Crestron) and consumer platforms (Google, Amazon) creates uncertainty. A project might demand a Zigbee motor one day and a Wi-Fi motor with Matter certification the next. This isn’t just a feature preference; it’s a hard requirement. Your forecast must be flexible enough to account for these different, non-interchangeable technological needs.

Internal Influences: Sales Enablement and Marketing

You can have the best product in the world, but if your sales team doesn’t understand it or isn’t motivated to sell it, it will sit on the shelf. The transition from selling a simple mechanical product to a complex electronic one requires significant internal training and new incentive structures. Likewise, your marketing must clearly explain the value proposition. If customers don’t understand why they need a smart curtain, your forecast, no matter how well-researched, will fail to materialize.

| Factor Type | Specific Factor | Influence on Forecast | Mitigation Strategy |

|---|---|---|---|

| External | Semiconductor Shortages | Disrupts motor supply, creates long lead times. | Qualify multiple motor suppliers; understand their supply chain. |

| External | Evolving Tech Standards | Makes specific motor types obsolete or in-demand. | Stay informed on standards like Matter; favor flexible platforms. |

| Internal | Sales Team Training | Low adoption if sales team can’t explain the product. | Invest in technical training and updated sales incentives. |

| Internal | Marketing Effort | Low demand if customers don’t understand the benefits. | Develop clear marketing materials focused on solutions, not specs. |

How does the adoption curve vary by market, and how should that shape forecasts?

You’ve launched a new, top-of-the-line smart curtain track system that integrates with high-end building automation systems. You’ve prepared a national forecast, expecting steady growth across all regions. However, you’re seeing massive demand from business hotels in major cities but almost zero interest from resort properties or in suburban residential markets. Your national forecast is a useless average, leading you to have stockouts in one market and overstock in another.

The adoption of smart curtain tracks varies dramatically by market segment, and forecasts must be shaped accordingly. High-end business hotels and luxury urban apartments are early adopters, demanding fully integrated systems (like KNX or Crestron) for a seamless guest or resident experience. In contrast, mid-range hotels, resorts, and suburban homes are slower to adopt, preferring simpler, standalone smart solutions controlled by a remote or a basic app. A successful strategy requires you to abandon a single national forecast and instead create separate, targeted forecasts for each distinct market segment.

We see this play out in our order book every day. An order for a new Hyatt in a downtown business district will almost always include a requirement for integration with their central guest room management system. The motor we supply for that project is completely different from the one we’d provide for a new beach resort, which might just want a simple, reliable remote-controlled solution. We learned to stop asking "how many smart tracks do you need?" and start asking "what kind of property is this and what experience are you creating?"

The Luxury vs. Mid-Range Divide

Luxury hotels and residences are selling an experience of effortless convenience. For them, smart curtains are not a novelty; they are part of an integrated smart environment where lights, temperature, and curtains adjust with a single command. These projects will almost always specify motors compatible with high-end systems. Mid-range properties, however, are more cost-sensitive. They adopt smart features as a marketable amenity, where a simple remote or app-controlled curtain provides a "wow factor" without the cost and complexity of a full BAS integration.

Business Traveler Hubs vs. Leisure Resorts

The needs of the end-user also dictate the technology. A business traveler in a city hotel appreciates the efficiency of a room that prepares itself for arrival or a "goodnight" scene that closes the blackout curtains. They are more tech-savvy and expect integration. A guest at a leisure resort is there to relax and disconnect. They may be less interested in complex smart features and more appreciative of a simple, intuitive remote control for the sheer curtains to let in the ocean view.

Regional Tech Preferences

Adoption also has a geographic component. Markets in North America and parts of Asia with a high concentration of tech companies and new construction tend to adopt integrated systems more quickly. European markets have a long history with established protocols like KNX, making it the de facto standard for high-end projects there. Understanding these regional technology biases is crucial for stocking the right components for the right market.

| Market Segment | Common System Type | Adoption Rate | Forecast Strategy |

|---|---|---|---|

| Luxury Business Hotel | Fully Integrated (KNX, Crestron) | High / Early Adopter | Focus on high-end, protocol-specific motor inventory. |

| Mid-Range Hotel | Standalone (Remote/App) | Moderate / Mainstream | Stock reliable, cost-effective, easy-to-install RF/Wi-Fi motors. |

| Urban Luxury Residential | Integrated or Ecosystem (Google/Alexa) | High / Early Adopter | Offer flexibility; stock both BAS and consumer-grade options. |

| Leisure Resort | Standalone (Remote Control) | Low / Late Adopter | Maintain low inventory; focus on simplicity and reliability. |

What strategies can mitigate demand volatility when ordering smart systems?

You need to place a large volume order for smart curtain motors to secure a good price, but the demand is incredibly volatile. A single large hotel project could wipe out your inventory, or a delayed project could leave you with a warehouse full of aging tech. You’re trapped between paying a premium for small, frequent orders and taking a huge financial risk on a large order that might not sell, especially if the technology changes.

To mitigate demand volatility, procurement managers should shift from large, speculative orders to flexible partnership strategies with their suppliers. This includes implementing a "components and assembly" model, where the supplier stocks the common base motors and you order the specific control modules as needed. Negotiating blanket orders with scheduled drawdowns and establishing clear communication channels for project pipelines also helps suppliers better manage their own inventory, reducing lead times and risk for everyone.

This is how we build our strongest partnerships. Our best clients don’t just send us purchase orders; they have open conversations with us about their project funnel. They tell us, "We have a potential 500-room hotel project that will need KNX compatibility, likely closing in Q3." This information doesn’t lock them into an order, but it allows us to make sure we have the necessary raw components in our own supply chain. It transforms the relationship from a simple transaction into a collaborative effort to manage risk.

The "Motors and Modules" Model

The most effective strategy is to de-couple the motor from its "brain." Work with a manufacturer who can stock a universal base motor. Then, based on confirmed project needs, you can order the specific communication module (e.g., a KNX module, a Zigbee module) for final assembly. This changes your inventory risk from holding many different types of finished motors to holding a single, more versatile base unit. This is the ultimate in just-in-time inventory management for a volatile product.

Blanket Orders with Scheduled Drawdowns

Instead of a single massive order, negotiate a blanket order for your estimated annual volume. This secures you favorable pricing. Then, create a drawdown schedule to release smaller shipments on a monthly or quarterly basis. A good contract will allow for some flexibility in this schedule, letting you pull forward or push back shipments by a few weeks to respond to real-world project timelines without penalty.

Transparent Project Pipeline Communication

The simplest and most powerful strategy is communication. Establish a regular (e.g., monthly) call with your key supplier to discuss your project pipeline. Share non-binding information about potential upcoming projects and their specific tech requirements. This forward-looking data is gold for a manufacturer. It allows them to pre-order long-lead-time components and better plan their production schedule, which ultimately translates into shorter lead times and more reliable supply for you.

| Strategy | How It Works | Key Benefit | Supplier Requirement |

|---|---|---|---|

| Motors and Modules | Stock universal base motors; add control modules as needed. | Drastically reduces inventory risk and obsolescence. | Supplier must have a modular product design. |

| Blanket Orders1 | Commit to annual volume, but receive staggered shipments. | Secures volume pricing while maintaining cash flow. | Supplier must have strong financial and inventory capacity. |

| Pipeline Transparency2 | Share non-binding info on future potential projects. | Reduces lead times and prevents stockouts. | Requires a trusting, collaborative partnership. |

Conclusion

Forecasting demand for smart curtain tracks is a new and complex challenge that requires a new way of thinking. The key is to look past the aluminum track and focus on the volatile but critical electronic components. By tracking the right leading indicators, like the adoption of building automation systems, and by understanding how different market segments adopt technology at different rates, you can move from blind guessing to informed prediction. Ultimately, the best strategy is not a perfect algorithm, but a strong, transparent partnership with your supplier, turning a risky supply chain into a shared competitive advantage.